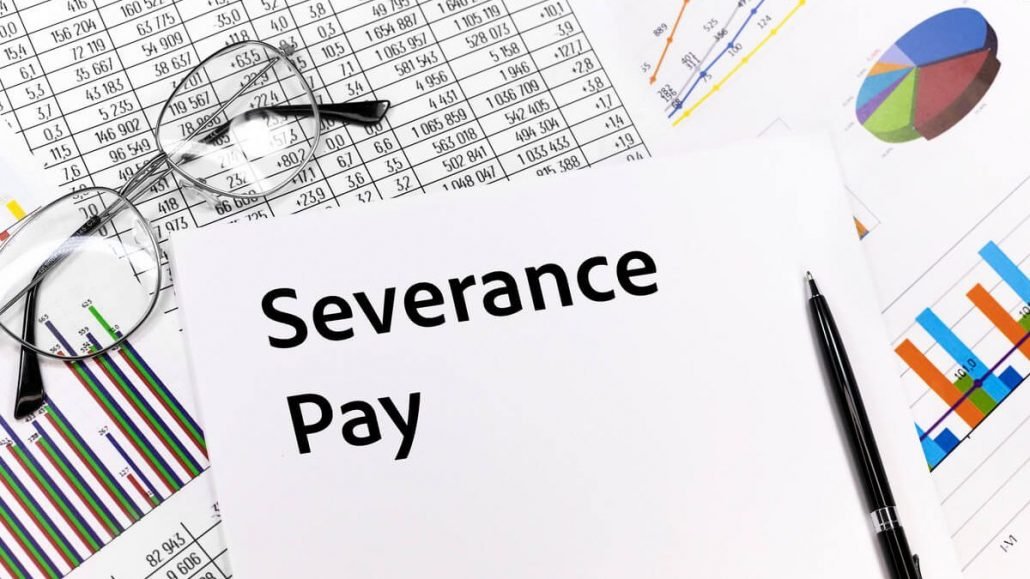

When an employment relationship ends in Germany, many employees receive severance pay as compensation for losing their job. Even though there is usually no statutory right to severance, employers often offer a payment to avoid lengthy disputes and financial uncertainty. The final amount depends on salary, length of service, region, industry, and the legal strength of the employee’s case. Our guide explains when severance becomes relevant, how amounts are typically calculated, and which strategic steps can strengthen the employee’s position and improve both gross and net outcomes.

Unfairly dismissed in Germany?

Check your severance pay now – you have only 3 weeks to preserve your severance package!

Key takeaways:

- Severance pay in Germany is a one-time payment that compensates employees for job loss. It is widely used, even though by German law, not every employee is entitled to a severance.

- Most severance is voluntary because dismissals are often legally vulnerable. Employers frequently pay severance to avoid the risk of losing a dismissal case.

- The “fair” amount depends on salary, years of service, region, industry and legal leverage. The strongest driver is the likelihood that the termination would be considered invalid.

- To improve the net result, employees should assess all claims, strengthen negotiation leverage and consider tax optimization strategies.

Contents

- What is severance pay?

- No severance entitlement

- How severance pay in Germany is calculated

- “Rule of thumb” for severance pay in Germany

- Strategies to maximise severance pay in Germany

- Additional financial considerations

- Taxation of severance pay

- Special cases

- Severance Pay After Termination – Table

- What to do after receiving a termination

- Frequently asked questions (FAQ)

What is severance pay?

Severance pay in Germany (“Abfindung”) is a one-off payment employees often receive when their employment ends, usually as compensation for the loss of the job. The law does not grant a general statutory right to severance, but employers often agree to pay it because negotiated outcomes offer predictability and avoid exposure to legal risks. Few employees realise how often terminations contain procedural or formal flaws that could make them invalid when challenged in court. Such flaws frequently drive severance negotiations.

Differentiating severance from other one-off payments is important, but not not always straightforward. Bonus payments, overtime compensation, unused vacation entitlements or back pay for periods after an invalid dismissal can be part of the same agreement. But they have very different tax and social security consequences. A poorly structured agreement may lead to parts of the payment being reclassified as salary.

No severance entitlement

Most employees do not have a general legal entitlement to severance. Payments mostly arise from voluntary arrangements, often because employers face real litigation risks. If a court concludes that the termination was invalid, the employer may owe back pay for the entire period until judgment, even if no work was performed, and may also need to bear legal costs.1

Challenging a dismissal often generates better results than many employees expect. German labor courts frequently identify legal weaknesses in terminations, especially when documentation is well preserved. Emails, time sheets, warnings, performance reviews and witness statements can shift negotiations significantly. A small evidentiary detail often changes the entire assessment of legal risk.

Only in specific, narrowly defined situations does a statutory right to severance exist. The most common is the operational dismissal scenario, where strict requirements must be met.

Severance pay is in most cases, “voluntarily paid”

Most severance payments arise from voluntary negotiations. Employers may propose a separation agreement to achieve a predictable and legally secure end to the working relationship. Employees should avoid quickly signalling interest in leaving. Demonstrating a preference to continue working strengthens negotiation leverage, especially when initial offers appear low.

Well-organised documentation improves bargaining power. Emails, internal guidelines, performance records and communication with supervisors often reveal inconsistencies in the employer’s reasoning. These inconsistencies can make a dismissal vulnerable, increasing the pressure on the employer to propose a settlement.

Settlements in court or out-of-court agreement

A mutual separation agreement ends the employment relationship by consent. Employers cannot force employees to sign such an agreement. Refusal does not extinguish rights. If the employer then issues a termination, the employee may challenge it through the dismissal protection process. Filing a claim often prompts employers to reassess legal risks, leading to improved proposals.

If no agreement is reached initially, employees often file a dismissal protection claim to preserve rights. Filing is not adversarial; it is the legally appropriate response to a questionable dismissal. Employees have only three weeks to file. Missing this deadline usually results in losing all claims. Most cases conclude within one to three months and typically end with a settlement, often including severance.

A dismissal protection claim provides structure, clarity and leverage. It freezes the timeline, preserves rights and compels the employer to confront legal vulnerabilities. It also prevents the three-week deadline from expiring, ensuring that the employee retains all strategic options and can negotiate without fear of forfeiting claims.

Statutory severance in operational dismissals

A statutory entitlement to severance exists only when several cumulative conditions are satisfied.

- First, the Dismissal Protection Act (KSchG) must apply. This requires more than six months of employment in a business employing more than ten employees.2

- Second, the dismissal must be based on urgent operational requirements, and this justification must appear in the termination letter.

- Third, the employer must inform the employee that they may claim severance only if they refrain from filing a dismissal protection claim within three weeks.

When all requirements are met, the statutory severance amounts to 0.5 monthly salaries per full year of service. This statutory right applies only to operational dismissals. It does not apply to behavioral or personal dismissals.

Court-ordered severance

In rare situations, courts may dissolve the employment relationship and award severance if continued cooperation is objectively unreasonable. This may occur in cases involving severe conflict or false allegations during proceedings. Such outcomes are uncommon because most disputes result in negotiated settlements before reaching a final judgment.

Severance from social plans

In larger restructurings, plant closures or mass layoffs, employers often negotiate social plans with works councils. These plans commonly specify eligibility rules and severance formulas based on age, length of service or dependents. Once adopted, social plans create binding rights for affected employees. Social plans aim to mitigate disadvantages resulting from structural changes and often provide predictable severance structures.

Other sources of severance rights

Collective agreements, works agreements or company-specific arrangements may contain severance rules for certain employee groups. Such provisions are more common in large companies, the public sector and industries with strong collective bargaining frameworks.

| Why statutory severance remains the exception: German dismissal law focuses primarily on job protection rather than paying compensation for job loss. Although most employment relationships end through negotiated settlements in practice, the legal system is designed to preserve employment where possible. This explains why statutory severance rights are limited and why most severance payments arise from negotiations rather than legal entitlements. |

How severance pay in Germany is calculated

The amount of severance pay in Germany depends on:

- Salary

- Years of service

- Region

- Industry

- Legal leverage

Negotiated outcomes vary widely. Employees who reach mutual agreements, accept severance-linked terminations or challenge dismissals commonly receive around one monthly salary per year of service. Negotiated exits often yield higher factors than straightforward terminations because employers may seek legal certainty and speedy resolution. Many terminations contain procedural or formal errors, making litigation outcomes unpredictable and influencing employers to settle.

“Rule of thumb” for severance pay in Germany

To estimate severance pay in Germany when an employment relationship ends, the following rule of thumb is commonly used:

Current monthly salary × years of service × “factor”

Example: An employee has worked for 6 years. Their most recent monthly salary, including bonus and company car, was EUR 7,500. With a factor of 1.1, the severance comes to EUR 49,500 (1.1 × 7,500 × 6 years = 49,500).

Monthly salary and years of service are easy to determine and offer little wiggle-room to influence the final amount of severance pay after termination in Germany. The factor is the decisive variable. It typically ranges from 0.5 to 2.0 – and yes, that is a pretty broad range!

A factor of 0.5 is the lower end and often used in an employer’s first offer. A realistic to good level of severance compensation in Germany usually sits between 0.75 and 1.25, depending on region, employer and the circumstances of the dismissal. Factors above 1.5 are rare and usually tied to special protection situations (e.g., parental leave, severe disability).

At the end of this article, you will find a rough estimation table. You can also use our calculator to determine your severance claim in

Current monthly salary

The first variable for calculating termination severance in Germany is the employee’s current monthly gross salary. It’s easy to determine – and difficult to influence. By the time severance discussions start, it is usually too late to negotiate a salary increase. Still, make sure nothing important is left out:

- Salary at the time of termination: The relevant figure is the last total gross salary at the moment the termination takes effect.

- Additional compensation: Current gross salary includes base salary plus regular additional payments such as overtime pay, bonuses, special payments and other recurring remuneration – including annual bonuses.

- Annual salary ÷ 12: To capture all components, employers often divide the most recent annual salary by twelve. This also reflects one-off annual payments (often paid in December).

Years of service

Years of service are also simple to determine (and cannot realistically be influenced). They are often rounded up:

- Parental leave, part-time work and training periods count:

- All periods in which the employment relationship existed count – whether full-time, part-time or during parental leave.

- Training periods usually count if employment continued seamlessly afterward.

- Parental leave is fully credited.

- Part-time work does not reduce years of service

- Unpaid special leave or interruptions may be excluded unless agreements state otherwise.

- Periods as a temporary agency worker or freelancer do not count toward dismissal compensation in Germany.

- Sabbaticals: Whether a sabbatical counts depends on the individual agreement.

Determining the severance factor

The severance “factor” usually ranges from 0.5 to 2.0 – sometimes even higher. This is a very broad range, and it can actually be influenced. It depends heavily on the legal risks for both sides, “social” factors, industry trends, region, company size, the employer’s economic situation – and of course the negotiation skills of the employee or their lawyer. The most important drivers are:

Prospects of success in a wrongful dismissal claim

The factor – and thus the final severance payment in Germany – increases when the dismissal can be legally challenged:

If a dismissal is likely invalid – for example due to incorrect social selection, lack of works council involvement, special protection, or formal errors – the employee has strong chances in court.

Employers often want to avoid lengthy litigation and the risk of reinstatement. They may offer higher layoff compensation in Germany to settle early. Many dismissal claims end in a settlement where the employee waives their job in exchange for severance.

The weaker the employer’s legal position, the more they must offer to secure a voluntary exit. Conversely, if the dismissal is likely valid, severance tends to be lower.

Misconduct-based dismissals that are 100% valid rarely result in severance. But they rarely are 100% valid.

All of the above only if the Protection Against Dismissal Act applies (or special protection applies). General protection only applies after six months in companies with more than ten employees.

Social criteria and employee position

Social criteria – such as age, marital status and dependents – can increase the factor and therefore the redundancy pay in Germany. Older employees or those with dependents are considered more socially vulnerable.

Special protection strengthens negotiation power and often leads to significantly higher severance.

Job level matters too: Managers typically receive higher factors because their dismissals are more complex and they hold more bargaining power.

Statistically, women receive lower severance amounts: On average, women receive roughly 10% less severance than men with identical profiles.

Region, industry, and company size

Severance levels vary significantly across regions:

- National average: Baden-Württemberg and Berlin

- Above average: Bavaria, Hamburg, Lower Saxony, North Rhine-Westphalia

- Below average: Brandenburg, Mecklenburg-Western Pomerania, Saxony-Anhalt, Saarland, Schleswig-Holstein

And of course, these “averages” are not about salary differences – it refers specifically and only to the severance factor. Two employees with identical salaries may receive drastically different severance depending on the state.

Industry differences also matter. High-factor industries include tech, energy, banking and insurance. Lower-factor industries include construction, healthcare and mechanical engineering.

Company size is another major driver: larger companies generally offer higher severance compensation in Germany. Small companies often cannot afford large payouts. In companies with fewer than ten employees, general dismissal protection does not apply at all – which indirectly limits severance.

Employer’s financial situation and interests

The employer’s economic situation and strategic goals (e.g., rapid downsizing) influence the factor.

Companies with financial difficulties tend to offer lower severance.

In restructuring processes with social plans, the factor is often standardized but still shaped by negotiation pressure.

If the employer urgently wants a quick separation, that usually increases the severance amount.

Filing an unfair dismissal claim

Filing a wrongful dismissal claim can strengthen an employee’s negotiating position. It preserves rights and signals seriousness. Employers often offer higher termination severance in Germany to avoid long litigation. Prospects of success and expected case duration matter here.

Special protection against dismissal

Certain groups – such as pregnant employees, employees on parental leave and employees with severe disabilities – have special protection against dismissal. The requirements for a valid dismissal are much stricter. As a result, dismissals are often invalid and termination is usually only possible voluntarily – which typically leads to significantly higher severance pay in Germany.

Strategies to maximise severance pay in Germany

Employees can materially improve severance outcomes through preparation, strategic communication and timely action. The first step is to assess the legal strength of the case. Gathering documentation, disputing performance allegations with evidence and identifying procedural flaws increase leverage.

Challenging a dismissal through a claim in court is often the most effective strategy because it prevents the three-week deadline from expiring and allows time for negotiation. It also builds pressure on the employer. Technically, employees may file such claims themselves, but the underlying rules are complex, and professional guidance can significantly reduce the risk of procedural mistakes.

Negotiation strategy also matters. Employees should remain factual, organised and consistent. Using the available three-week period wisely helps structure the negotiation. Avoiding rushed decisions and maintaining a professional tone typically lead to better results. Employees who can demonstrate discrepancies in the employer’s reasoning often shift negotiations in their favour.

Additional financial considerations

Severance is only one part of the financial outcome. Employees frequently overlook other entitlements.

Back pay may be owed when a termination is invalid. If the employer fails to issue a valid termination, earnings may continue to accrue even without work performed. Depending on duration, back pay can exceed typical severance amounts.

Bonus payments, commissions, and other variable compensation are often contractually owed and must be claimed separately. They should not be subsumed into the severance payment unless explicitly agreed and properly valued.

Outstanding overtime and unused vacation days must be settled. These amounts can become substantial when combined with other claims.

A sprinter clause allows employees to leave earlier than the agreed termination date in exchange for an additional payment often linked to salary savings. This mechanism can enhance the overall payout and offer flexibility when employees wish to move on quickly.

Taxation of severance pay

Severance pay is subject to income tax but exempt from social security contributions. Poorly structured payments may trigger high taxes due to progressive rates. Strategic timing can mitigate tax burdens. For instance, arranging payment in a year with lower overall income, coordinating deductible expenses or leveraging the one-fifth rule can reduce tax. Employees should note that from 2025, employers no longer apply the one-fifth rule automatically. Instead, the tax advantage is granted during the annual assessment. Larger severance packages should be reviewed with a tax adviser to avoid unnecessary burdens and protect net outcomes.

Special cases

Severance in insolvency situations depends on the financial condition of the insolvency estate and usually involves negotiations with the insolvency administrator. Severance in plant closures or mass layoffs often stems from structured formulas negotiated with works councils through social plans. Public-sector dismissals are subject to distinct statutory rules and generally require either social plan provisions or negotiated settlements. Even in these special cases, gathering documentation remains essential because inconsistencies in the process can improve negotiation leverage and shift outcomes substantially.

Severance Pay After Termination – Table

The following table shows typical severance amounts based on different “factors”:

| Length of employment | Realistic severance | Good to very good severance | Very good to exceptionally high severance |

| Severance after 1 year | 0,75 x monthly gross pay | 1,0 x monthly gross pay | 1,5 x monthly gross pay |

| Severance after 2 years | 1,5 x monthly gross pay | 2 x monthly gross pay | 3 x monthly gross pay |

| Severance after 4 years | 3 x monthly gross pay | 4 x monthly gross pay | 6 x monthly gross pay |

| Severance after 10 years | 7,5 x monthly gross pay | 10 x monthly gross pay | 15 x monthly gross pay |

| Severance after 15 years | 11 x monthly gross pay | 15 x monthly gross pay | 22,5 x monthly gross pay |

- 0.75 – Realistic severance: A factor of 0.75 is – depending on the individual case and the competent labor court – a realistic expectation in many proceedings. For employees represented by an attorney and with a solid case, court settlements based on this factor are common. The decisive elements are the circumstances of the individual case, the “severity” of the dismissal, the employer and the region.

- 1.0 – Good to very good severance: With a strong case or a strong attorney, it is often possible to negotiate a factor of 1.0 or higher. A factor of 1.0 is generally considered “good,” depending on the circumstances of the case, the severity of the dismissal, the employer and especially the region. In major cities in southern Germany, this value is not unusual.

- 1.5+ – Very good to exceptionally high severance: Across all regions, a factor significantly above 1.0 is considered very good. Again, everything depends on the specific circumstances. Employees who enjoy special protection against dismissal – for example due to parental leave, severe disability or works council activity – can realistically expect higher severance amounts.

What to do after receiving a termination

Employees should act quickly. The three-week period to challenge a dismissal is strict, and missing it usually eliminates all legal options. Preserving evidence, gathering documents and examining whether the termination is legally valid are critical first steps. Filing a dismissal protection claim is standard practice in Germany and often improves the negotiation landscape, even for employees who do not wish to return to their position. Once a severance offer is made, employees should compare it with realistic entitlements, including outstanding bonuses, unused vacation pay and overtime, to avoid leaving money behind.

Frequently asked questions (FAQ)

How much severance pay are you entitled to? Calculate now!

- Calculate your individual severance pay for free

- Calculation of the standard payment up to a very high settlement

- Get a strategy to maximise your severance pay